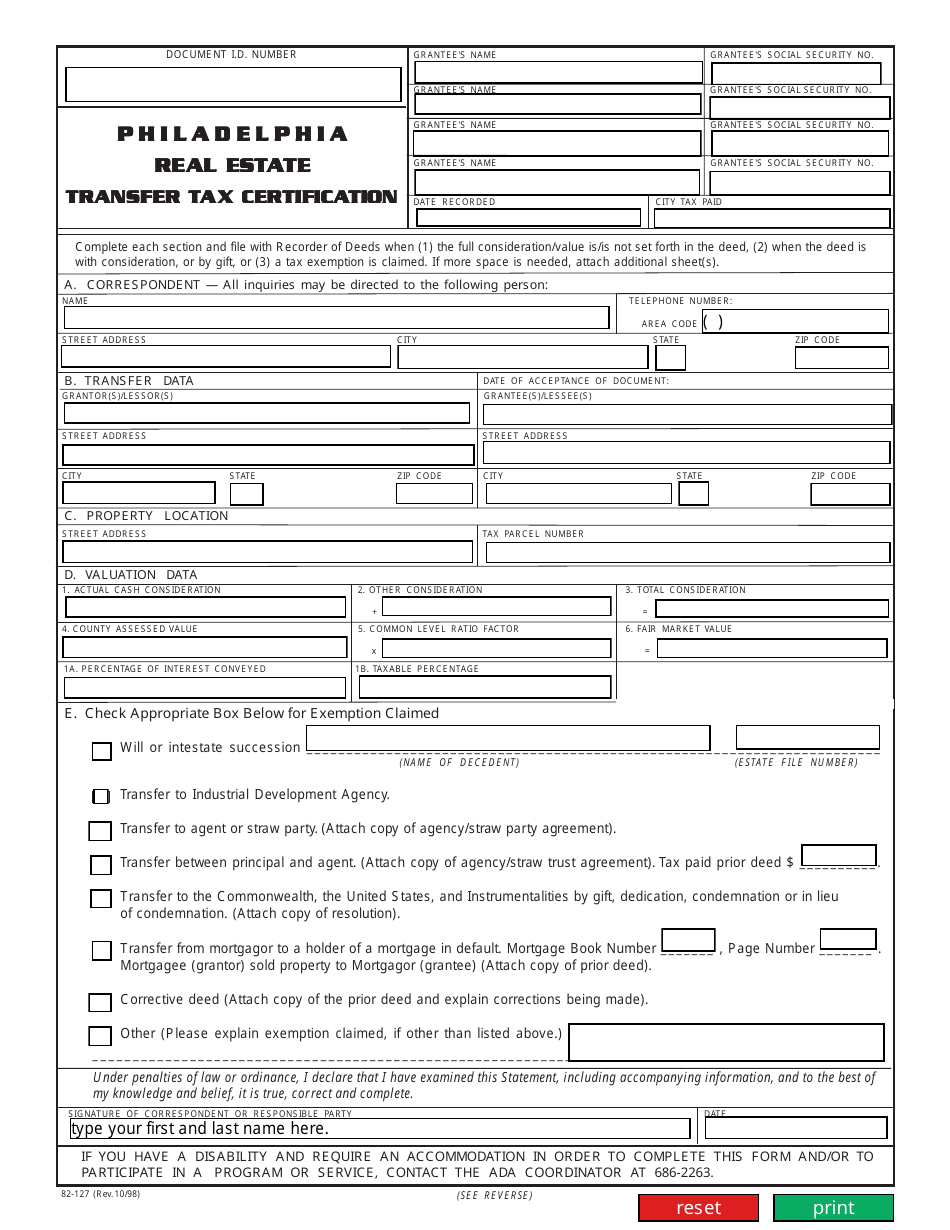

philadelphia transfer tax form

Technical private letter rulings. THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION.

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Tobacco and Tobacco-Related Products Tax.

. Click here to download the City Transfer Tax Ordinance About the Office of The Sheriff of Philadelphia As the pandemic continues the Philadelphia Sheriffs Office wants to ensure that Philadelphia residents can remain in their homes which is why the Sheriffs Office supports any programs that help residents. Enter the name address and telephone number of party completing this form. Philadelphias transfer tax is one of the highest rates within Pennsylvania.

Look up your property tax balance. Enter the date on which the deed or. The current rates for the Realty Transfer Tax are.

The transfer tax in philadelphia is 3 and on transfers for nominal consideration the tax is based upon the fair market value of the property. Recently taxpayers have taken advantage to substantial discrepancies between assessed and market values to lower realty. Paying by mail is an option.

The jurisdiction for the applicable tax rates. You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees. Instructions for completing philadelphia real estate transfer tax certification Section A Correspondent.

Select the document you want to sign and click Upload. Is the deed transfer tax exempt. Enter the name address and telephone number of party completing this form.

Bureau of individual taxes po box 280603. PA Realty Transfer Tax and New Home Construction REV-715 -- Realty Transfer Tax Monthly Report REV-1651 -- Application for Refund PA Realty Transfer Tax REV-1728 -- Realty Transfer Tax Declaration of Acquisition Revenue Code Chapter 91 -- Revenue Code - Chp 91. Sales Use.

Section B Transfer Data. How is Philadelphia transfer tax calculated. Nominal consideration or under the intestate succession.

Fill Sign Philadelphia Form Transfer Tax 1993. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a. Philadelphia Beverage Tax.

When you submit the sale document for recording you will be required to pay the Real Estate Transfer Tax. Instructions for completing realty transfer tax statement of value this statement must be signed by a responsible person connected with the transaction. If no sales price exists the tax is calculated using a formula based on the property value determined.

Instructions for completing philadelphia real estate transfer tax certification Section A Correspondent. A typed drawn or uploaded signature. Kennedy Boulevard Concourse Level Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600 Taxes.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 266 to a delaware limited partnership the transaction will give rise to philadelphia realty transfer tax. This declaration must be signed by a.

Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a total of 4278. The consideration is not stated in total on the face of the document it must either be stated.

Regulations rulings tax policy. Stay away from spending unneeded time use only up-to-date and accurate form templates by US Legal Forms experts. If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA.

Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. Decide on what kind of signature to create. Philadelphia Pennsylvania Realty Transfer Tax Statement of Consideration Download the form youre searching for from your website library.

Philadelphia transfer tax form real estate. We use cookies to improve security personalize the user experience enhance our marketing. Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred.

Section B Transfer Data. Create your signature and click Ok. Follow the step-by-step instructions below to design your philadelphia transfer tax form.

Failure to complete this form properly or attach requested documentation may result in the recorders refusal to record the deed. 2 x 100000 2000. Philadelphia beginning July 1 2017 will begin to tax transfers of interests in real estate entities based on the selling price of the entity rather than the computed value assessed value102 of the realty.

REV-183 -- Realty Transfer Tax Statement of Value REV-618 -- Brochure. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. Department of Revenue Municipal Services Building 1401 John F.

A11 Probate Guide Example Notice to Heirs 180 City Hall Philadelphia PA 19107 215-686-6250 Date you filled out form X Your Name Your Address. There are three variants. For comparison Montgomery County Pennsylvanias transfer tax is only 1.

If you are changing the address of your business you must complete a Change Form in order to register the new location with the Department of Revenue. If you dont have an account yet register. The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax.

Enter the date on which the deed or. One to the Recorder of Deeds for 25675 one to the City for 3278 percent of the selling price plus any assumed debt and one to the Commonwealth for one percent of the sale price plus any assumed debt. Enter the name address and telephone number of party completing this form.

Which state and local realty transfer tax is due. And estate file number in the space provided. CORRESPONDENT INFORMATION Enter the name address and telephone number of party completing this form.

Get the free philadelphia realty transfer tax form 2011-2022 Get Form Show details Hide details A statewide list of the factors is available at the Recorder of Deeds office in each county. The state realty transfer tax is 1 of the total computed value. 2 x 100000 2000.

Philadelphia County Gift Deed Form Pennsylvania Deeds Com

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

Coronavirus Bulletin Board Aids Law Project

Philadelphia County Quit Claim Deed Form Pennsylvania Deeds Com

Qualified Disaster Distributions Vs Stimulus Checks What Are The Differences Marca

Philadelphia Subpoena Form Form Ead Faveni Edu Br

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

Philadelphia Neufchatel Cheese With 1 3 Less Fat Than Cream Cheese 8 Oz Brick Walmart Com

Philadelphia County Gift Deed Form Pennsylvania Deeds Com

Map Of Philly First Settlement Grants Progress Report Long Description Philadelphia City Council

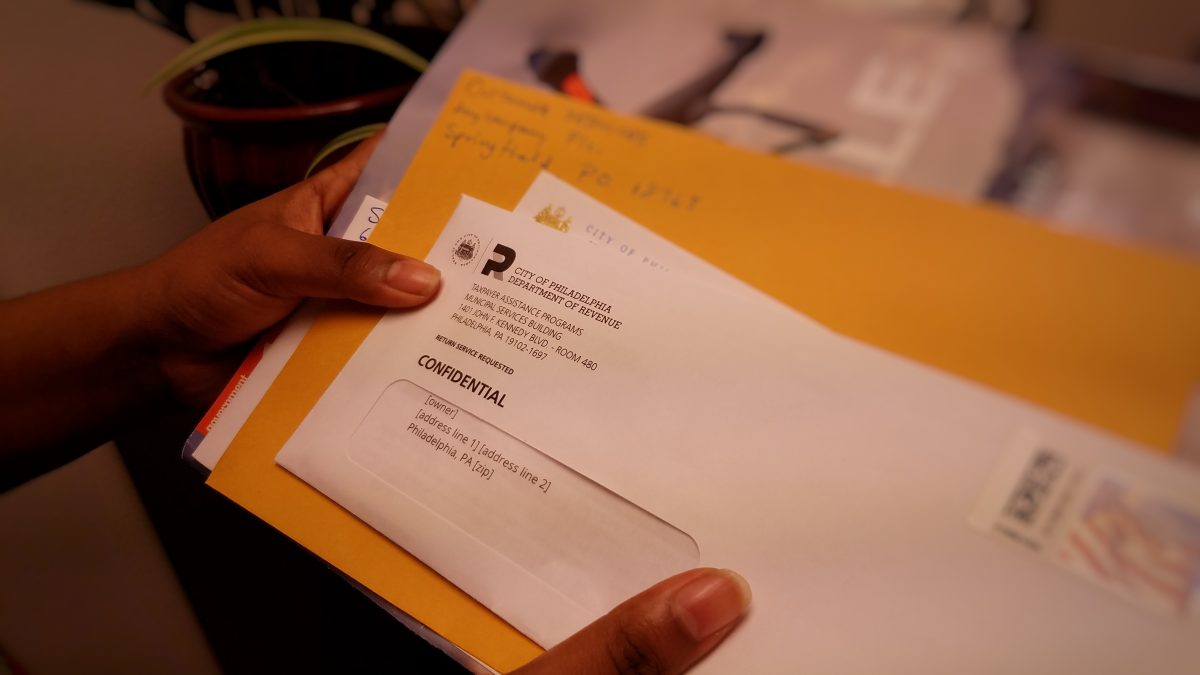

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Tax Associate Resume Examples And Templates That Got Jobs In 2022 Zippia

United Bank Of Philadelphia Review Black Owned Low Minimum Deposits

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia